Driven by the " carbon peak and neutral " strategy, China's new energy industry is accelerating its development. In 2021, the national sales of new energy vehicles will reach 3.545 million, a year-on-year increase of 159.3%, and the domestic penetration rate of new energy vehicles will reach 13.4%. The new energy vehicle market in Europe has risen in the past two years. In the eight European countries dominated by Germany, France, the United Kingdom, Norway, Italy, Sweden, Spain and the Netherlands, the overall penetration rate in 2021 is about 21%, and the United States is only 4%. Global new energy vehicles are in a period of rapid development. As the global new energy industry has entered a stage of rapid development, lithium, as an essential element in the new energy industry, has experienced exponential growth in demand. As of May 2022, the price of domestic battery-grade lithium carbonate has exceeded 450,000/ton, a five-fold increase year-on-year.

Domestic demand for battery grade lithium carbonate

In the next five years, the huge demand for power batteries in the new energy vehicle market will drive a significant increase in the domestic demand for battery-grade lithium carbonate

Battery-grade lithium carbonate is the core raw material for the production of positive electrode materials for power batteries of new energy vehicles. According to the positive electrode materials used in power batteries, the positive electrode materials used in power batteries installed in new energy vehicles are mainly lithium iron phosphate batteries and ternary batteries.

1GWh power battery According to the theoretical deviation caused by the yield rate and production process in actual production, the actual amount of positive electrode material required by the unit is: lithium iron phosphate is about 2150 tons/GWh, corresponding to 0.25 tons of batteries per ton of positive electrode material grade lithium carbonate; ternary is about 2000 tons/GWh, corresponding to 0.43 tons of battery grade lithium carbonate per ton of cathode material. In 2021, the total domestic power battery production has reached 219.26 GWh, corresponding to a demand of 120,200 tons of battery-grade lithium carbonate. It is estimated that domestic power battery production will reach 2,498.5 GWh in 2030, corresponding to a demand of over 1.115 million tons of battery-grade lithium carbonate.

Referring to the 2021-2030 change trend of global consumer and energy storage battery-grade lithium carbonate, it is estimated that the domestic market demand for consumer and energy storage battery-grade lithium carbonate in 2030 will be about 259,000 tons and 217,000 tons, respectively. By 2030, the total domestic demand for battery-grade lithium carbonate will reach more than 1.59 million tons, and the cumulative demand for battery-grade lithium carbonate from 2021 to 2030 will exceed 7.524 million tons.

Domestic lithium resource supply and the gap between supply and demand

Insufficient supply of upstream lithium resources has led to a low level of domestic production capacity release.

Due to the continuous improvement of the new energy vehicle market, the traditional leading lithium salt processing enterprises headed by Tianqi Lithium Industry and Ganfeng Lithium Industry and the lithium salt processing rookie represented by Nanshi Lithium have announced the expansion of battery-grade lithium carbonate in recent years. plan. According to incomplete statistics, China's battery-grade lithium carbonate production capacity will reach 223,000 tons in 2021, but according to interviews with industry insiders, the capacity utilization rate of battery-grade lithium carbonate production lines of leading domestic enterprises is only about 60%. The main reason for this phenomenon is the insufficient supply of upstream lithium resources.

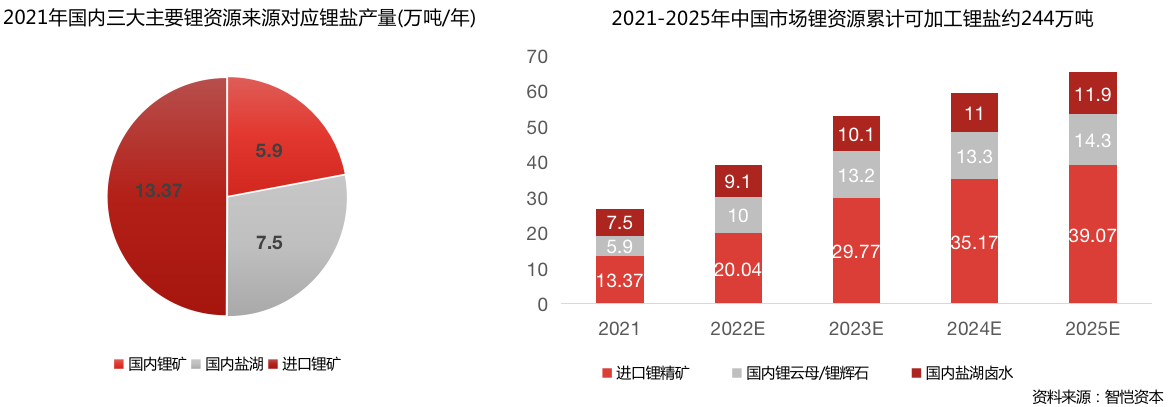

Australian lithium concentrate is currently the main channel for China's overseas supply of lithium resources, while domestic sources are mainly salt lake brine in Qinghai-Tibet region, spodumene and lepidolite in Sichuan region.

The proven lithium resource reserves in the world today are mainly lepidolite, spodumene and salt lake brine. Among them, salt lake brine lithium resources are mainly distributed in South America. South America’s lithium triangle region (Bolivia, Chile, Argentina) accounts for nearly 60% of the world’s total lithium resource reserves. Due to the special form of brine, most lithium salt processing enterprises choose to build production near the salt lake. line, which directly converts brine into finished lithium salt and then sells it to material processing enterprises in downstream countries, such as Panasonic and Samsung Electronics. Salt lake brine is also the main form of lithium resource reserves in China. It is mainly distributed in the Qinghai-Tibet region, accounting for 76% of the total proven domestic resources, while spodumene and lepidolite account for 14% and 10% of the total resources, respectively. Although spodumene is the main source of lithium resource supply in the world at this stage, salt lake brine with abundant resources may become the main growth pole of lithium resource supply in the future.

Compared with salt lake brine, ore resources are easier to transport, so lithium concentrate has become the main commodity in today's global lithium resource trading market. Australia now has the world's most abundant lithium mine resources, accounting for more than 90% of the world's total exports of this reserve type. Australian lithium concentrate is also the main channel for importing lithium resources in the Chinese market. In 2020, Chinese’s lithium raw material production accounted for only 24% of the world's total, while the basic lithium salt smelting capacity accounted for about 70% of the world's total. China has mastered the vast majority of the world's lithium processing capacity, but the self-supply capacity of resources and raw materials is obviously insufficient, and lithium mines are highly dependent on import. Among them, Australia's imports account for as much as 60% of China”s's lithium concentrate demand.

China is one of the countries with the richest reserves of lepidolite in the world. However, due to the technical bottleneck of lithium extraction from mica, the cost of extracting lithium from mica is relatively high, so it is rarely used in production.

Data source: Research and organization by ZK Capital

The Chinese market has become the world's largest lithium resource processing market in recent years, but China's lithium resource reserves only account for 6% of the world's total reserves. Therefore, Chinese lithium salt processing companies have signed a large number of offtake agreements with major lithium mines in recent years. In 2021, the total annual production capacity of lithium concentrate in the world will be about 3 million tons, of which the lithium concentrate offtake agreement signed by Chinese lithium salt companies and mines will reach 1 million tons per year, accounting for 1/3 of the global annual export volume of lithium concentrate. Australian lithium mine resources are also an important target for Chinese lithium salt processing enterprises to deploy overseas lithium resources. The way to stabilize the supply of its own lithium resources is through the equity of large mines. With the new round of lithium concentrate production lines being put into operation in 2022-2025 and the formal signing of the intention underwriting agreement, it is expected that by 2025, Australia's lithium concentrate imports will account for nearly 60% of the total lithium resource market supply in China.

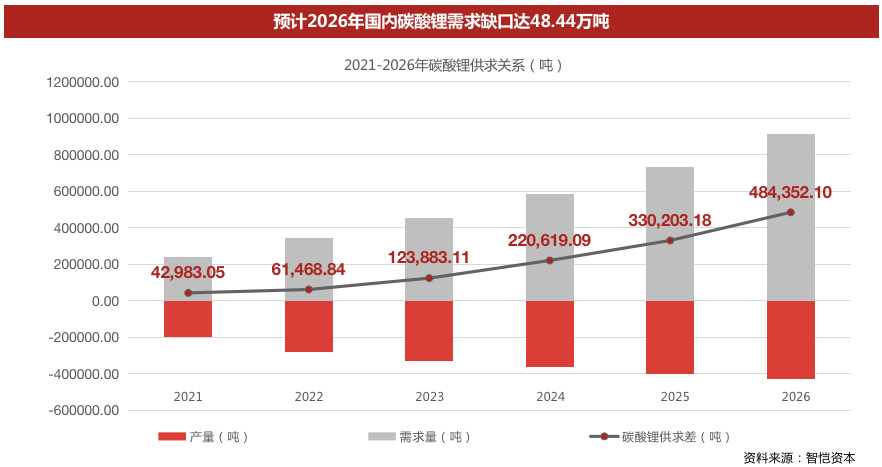

Due to the restrictions on the exploitation of upstream lithium resources and the large demand in the downstream battery market, the supply of lithium resources will continue to have a demand gap in the next few years.

Data source: Research and organization by ZK Capital

It is estimated that in 2022, the gap between the domestic lithium carbonate resource end and the downstream demand end will be around 61,500 tons. After 2023, due to the rapid growth of demand for new energy vehicle power batteries, the market demand for battery-grade lithium carbonate will increase rapidly, and the demand gap will continue to expand. The gap is expected to reach 484,400 tons by 2026. Due to the insufficient supply of the resource end itself, and related factors such as the epidemic will continue to affect the supply of the resource end, the resulting gap between supply and demand needs to be filled by the recycling end. Based on this, it can be predicted that the lithium recycling industry will continue to maintain its popularity in the next few years, and the prospects are bright.

Power battery recycling industry has great potential

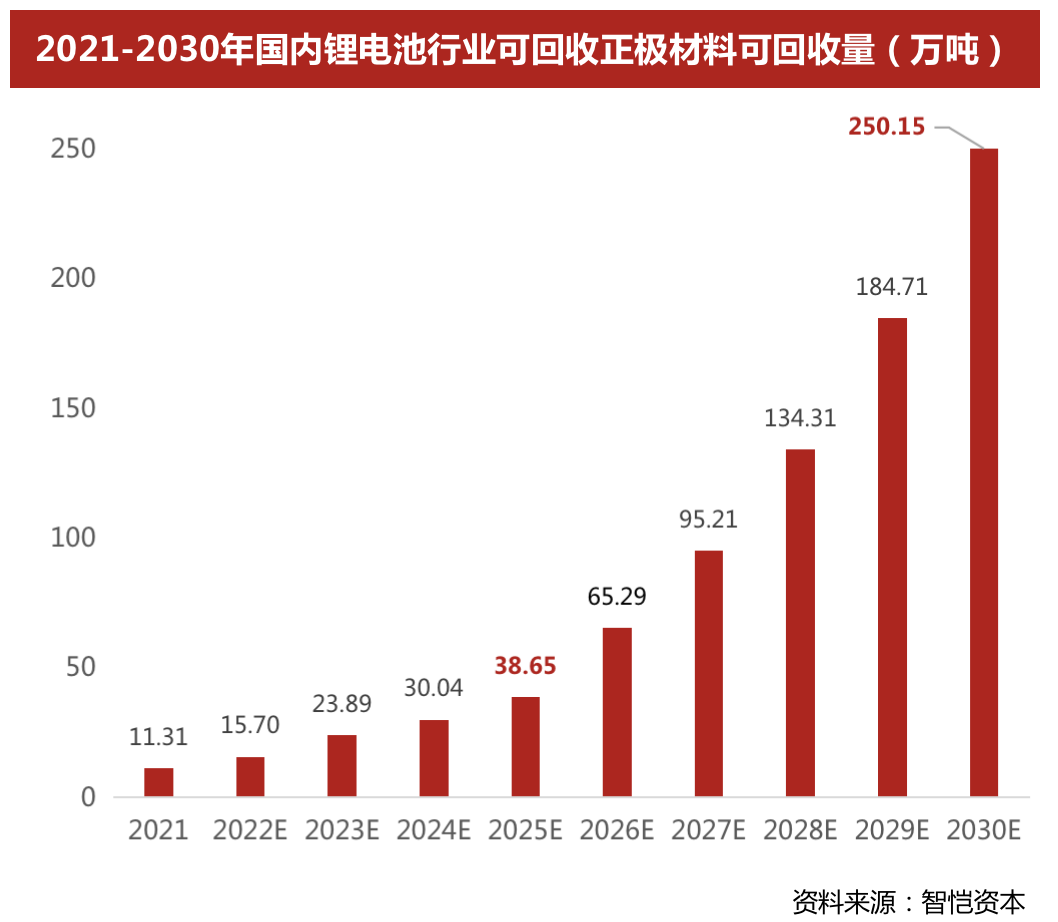

At present, the main sources of recyclable cathode materials in the domestic lithium battery industry are the recycling of decommissioned vehicle power batteries, the production of lithium batteries and the loss of cathode materials. In 2021, a total of about 113,000 tons of positive electrode materials will be recycled through these three types of channels, and the annual recycling volume is expected to reach 2.502 million tons in 2030. From 2021 to 2030, it is estimated that the domestic lithium battery industry will accumulatively recover 5.74 million tons of lithium iron phosphate battery cathode materials and 2.75 million tons of ternary battery cathode materials.

Recycling of Decommissioned Vehicle Power Batteries

The battery capacity of the power battery will gradually decay during the cycle discharge process. When the power battery decays below 80%, the electrochemical performance of the power lithium battery will be difficult to meet the normal power demand of the electric vehicle. For the consideration of environmental protection and economy, the battery needs to recycle. There are usually two methods for the recycling of power batteries: cascade utilization and dismantling and recycling. Cascade utilization refers to the complete recycling of batteries with a life span of 20%-80% for use in scenarios such as low-speed electric vehicles and grid energy storage. Because there are still some problems in technology and market, cascade utilization is mostly in the initial and pilot stage. In terms of technology, power batteries and energy storage batteries follow different technical standards, and the energy storage field has high temperature performance requirements for batteries, while some decommissioned power batteries may not meet the use requirements of energy storage batteries. The battery life prediction model is not perfect, which causes difficulties in the evaluation and detection of gradient utilization of decommissioned power batteries.

According to incomplete statistics, taking lithium iron phosphate batteries as an example, at present, the proportion of scrapped lithium iron phosphate batteries in my country for cascade utilization is less than 20%. Dismantling and recycling is to recycle and reuse rare metal elements such as nickel, cobalt, and manganese in the battery positive electrode material whose battery performance has been reduced to less than 20%. Since there is no nickel, cobalt and other precious metals in lithium iron phosphate batteries, the dismantling effect is not high, so most of the decommissioned power batteries that will be dismantled and recycled before 2025 are ternary lithium batteries.

|

|

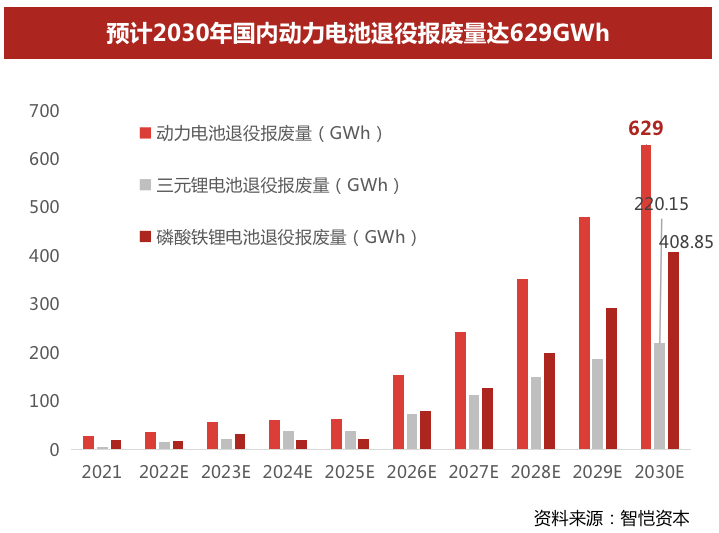

Data source: Research and organization by ZK Capital

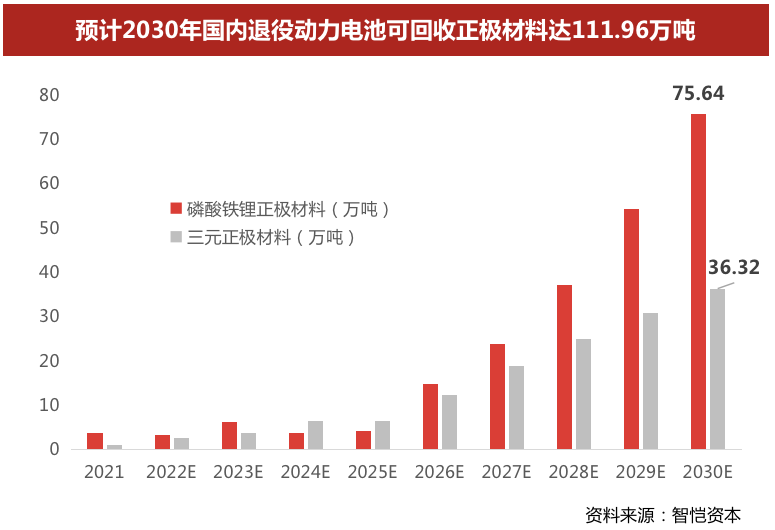

Assume that the effective life of the ternary battery and the lithium iron phosphate battery is 5 years. Therefore, as of now, the first batch of power batteries have reached the retirement age, and there will be a relatively continuous and expanding power battery recycling market in the future. Under this assumption, all ternary and lithium iron phosphate batteries installed in 2015 will be dismantled and recycled in 2020, and so on. It is estimated that by 2030, the amount of decommissioned batteries nationwide will reach 629GWh. According to the theoretical demand for positive electrode materials for 1GWh power batteries, it is about: lithium iron phosphate 1850 tons/GWh, ternary NCM 1500~1800 tons/GWh (high nickel ternary is between 1500~1650), and the median is estimated In 2030, about 1,119,600 tons of cathode materials can be recycled from decommissioned batteries, and the cumulative amount of cathode materials that can be recycled from 2021 to 2030 will exceed 3,703,300 tons.

Lithium battery production scrap

Data source: Research and organization by ZK Capital

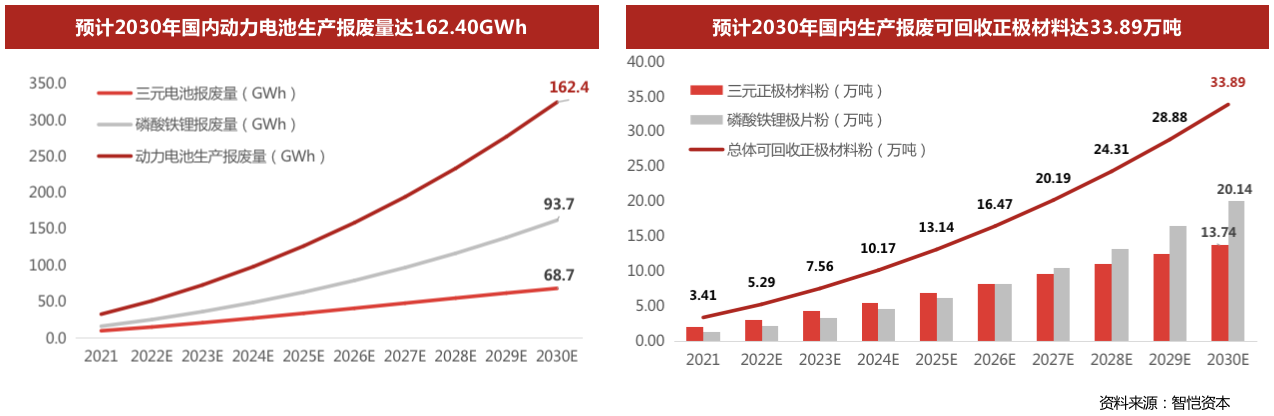

In 2021, the domestic output of lithium iron phosphate batteries will be 125.45GWh, and the output of ternary batteries will be 93.81GWh. The production loss rates of the top ten domestic market share of lithium iron phosphate batteries and ternary lithium battery manufacturers will be 3% to 5%, respectively. 10% to 12%. Based on the average production loss rate of the top ten domestic battery manufacturers, it is estimated that the production scrap of lithium iron phosphate batteries will reach 93.7Gwh in 2030, and the production scrap of ternary batteries will reach 68.7GWh, corresponding to about 338,900 tons of positive electrode materials. From 2021 to 2030 In the production process of ternary and lithium iron phosphate batteries, the cumulative number of scrapped and recyclable positive electrode materials exceeded 1.633 million tons.

Cathode material production loss

Data source: Research and organization by ZK Capital

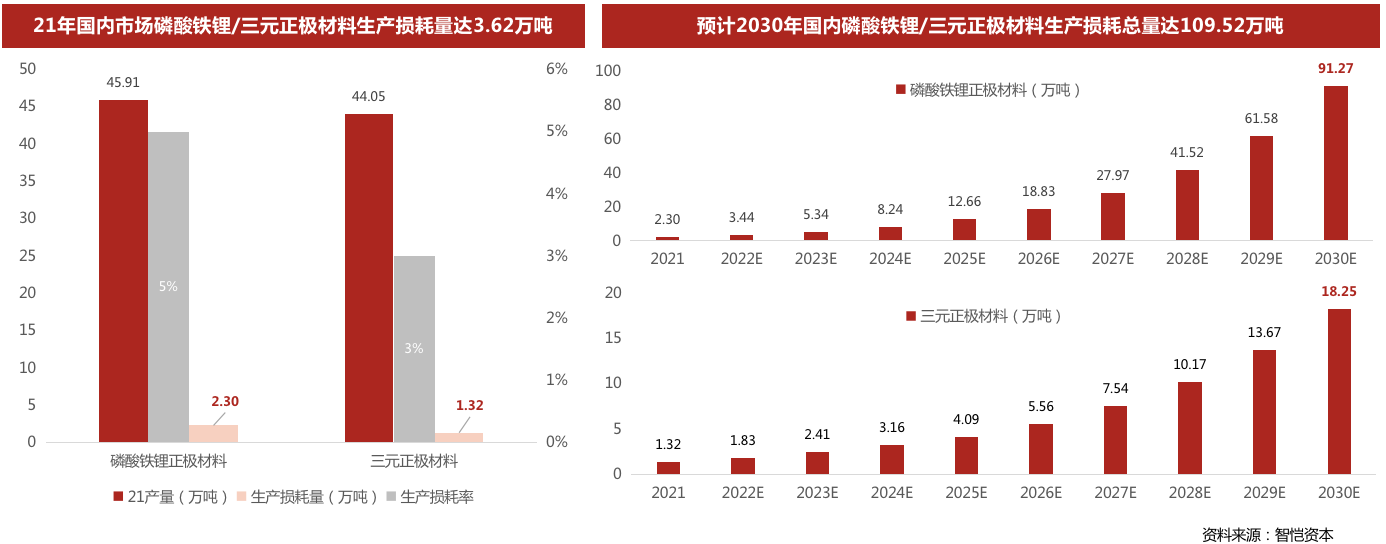

In 2021, the total output of domestic lithium iron phosphate cathode material manufacturers will be 459,100 tons, and the total output of ternary cathode material manufacturers will be 440,500 tons. According to the average production loss rate of domestic lithium iron phosphate and ternary cathode material factories, they will be 5% and 3% respectively It is estimated that the total production loss of lithium iron phosphate and ternary materials will reach 36,200 tons in 2021, and it is estimated that the total production loss of lithium iron phosphate and ternary cathode materials will reach 1.0952 million tons in 2030. The cumulative production loss of the Sanyuan cathode material factory reached 3.411 million tons.

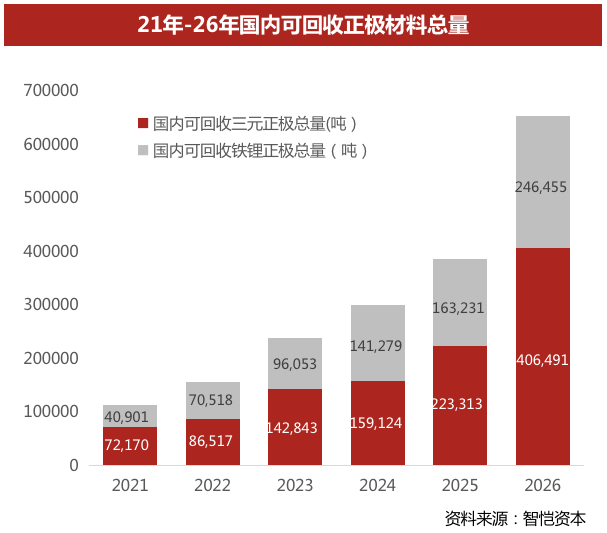

The total amount of positive electrode materials that can be recycled in three ways in the market

|

|

Data source: Research and organization by ZK Capital

In 2021, a total of nearly 113,000 tons of cathode materials will be recovered through the above three types of channels. In 2026, the annual recovery of cathode materials in the market is expected to reach about 652,900 tons. It is estimated that the domestic lithium battery industry can recycle 406,500 tons of lithium iron phosphate battery cathode materials. 246,500 tons of positive electrode materials for primary batteries. In 2030, the annual recycling volume is expected to reach 2.5015 million tons. From 2021 to 2030, it is estimated that the domestic lithium battery industry will accumulatively recover 5.7405 million tons of lithium iron phosphate battery cathode materials and 2.7522 million tons of ternary battery cathode materials.

National policy tends to favor power battery recycling

In recent years, the State Council, the Ministry of Industry and Information Technology, and the Ministry of Environmental Protection have issued guidance on power battery recycling to standardize the power battery recycling system and promote the maximum and efficient use of resources.

As early as April 2012, the State Council issued the "Energy Saving and New Energy Automobile Industry Development Plan (2012-2020)", which proposed that strengthening the cascade utilization and recycling management of power batteries is one of the five key tasks. In February 2017, seven departments including the Ministry of Industry and Information Technology, the Ministry of Science and Technology, and the Ministry of Environmental Protection jointly issued the "Interim Measures for the Recycling and Utilization of Power Batteries for New Energy Vehicles", pointing out that it is necessary to encourage battery manufacturers to cooperate with comprehensive utilization companies. Under the premise of ensuring safety and controllability, According to the principle of cascade utilization first and then regeneration, the waste traction batteries are rationally utilized in multi-level and multi-purpose. In May of the same year, the National Standardization Management Committee issued the "Recycling and Dismantling Specifications for Power Batteries for Vehicles", which was officially implemented on December 1, 2017. It clearly pointed out that recycling and dismantling enterprises should have relevant qualifications, which further ensured the power battery Safe, environmentally friendly and efficient recycling.

In July 2018, the Ministry of Industry and Information Technology released the list of the first batch of enterprises in the "Industry Standard Conditions for the Comprehensive Utilization of Waste Power Batteries of New Energy Vehicles", and a total of 5 enterprises were on the "white list". In December 2020, the Department of Energy Conservation and Comprehensive Utilization of the Ministry of Industry and Information Technology released the "List of Industry Standardized Enterprises for the Comprehensive Utilization of Scrap Iron and Steel, Waste Plastics, Waste Tires, and New Energy Vehicle Waste Power Batteries" and announced the second batch of companies that comply with the regulations. A total of 22 companies were on the list.

In September 2021, the State Administration for Market Regulation issued the national standard "Echelon Utilization of Vehicle Power Batteries", which formulated detailed and compliant national standards for the automotive industry in the field of vehicle power battery cascade utilization, and improved the recycling of vehicle power batteries. Use the standard system.

In November 2021, the Department of Energy Conservation and Comprehensive Utilization of the Ministry of Industry and Information Technology released the list of companies (third batch) that meet the "Industry Standard Conditions for Comprehensive Utilization of Waste Power Batteries of New Energy Vehicles". In the list of the third batch of enterprises announced this time, Kingchem Cycle belongs to the type of "recycling" enterprises. "Recycling" refers to the recycling of valuable metals in raw materials after dismantling waste power batteries to produce metals or raw materials and chemical raw materials used in manufacturing batteries. This time, Kingchem Cycle was selected into the list of enterprises that meet the "Specifications", which reflects the official's high recognition of Kingchem Cycle in terms of power battery recycling.

Ending

In the next five years, the huge demand for power batteries in the new energy vehicle market will drive a significant increase in the domestic demand for battery-grade lithium carbonate. Leading domestic lithium salt processing enterprises have been actively building new production lines for battery-grade lithium carbonate in recent years, and their production line expansion plans will be realized in 2022-2025. It is estimated that by 2025, the total annual production capacity of the top 10 domestic battery-grade lithium carbonate 318,400 tons, but the insufficient supply of upstream lithium resources has led to a low level of domestic production capacity release. After 2025, the production capacity planning layout of most enterprises has not yet been clarified. Based on the currently announced capacity expansion plans, the domestic production capacity of battery-grade lithium carbonate in 2030 will be 362,400 tons.

In 2021, imported lithium resources will account for 50% of China's total supply of lithium resources, while domestic lithium resources will mainly come from salt lake brine in Qinghai-Tibet region, spodumene and lepidolite in Sichuan region. The restriction on the mining of upstream lithium resources and the large demand in the downstream battery market will lead to a continuous demand gap in the lithium resource market in the next few years. It is estimated that in 2022, the gap between the domestic lithium carbonate resource end and the downstream demand end will be around 61,500 tons. After 2023, due to the rapid growth of demand for new energy vehicle power batteries, the market demand for battery-grade lithium carbonate will increase rapidly, and the demand gap will continue to expand. The gap is expected to reach 484,400 tons by 2026.

The ever-expanding gap in demand for lithium resources has prompted power battery recycling to become the next outlet for new energy. In 2021, nearly 113,000 tons of positive electrode materials can be recycled through the recycling of decommissioned power vehicle batteries, the scrapping of lithium battery production, and the production loss of positive electrode materials. In 2030, the annual recycling volume is expected to reach 2.5015 million tons. From 2021 to 2030, it is estimated that the domestic lithium battery industry will accumulatively recover 5.7405 million tons of lithium iron phosphate battery cathode materials and 2.7522 million tons of ternary battery cathode materials.

In addition, national policies tend to be favorable. The State Council, the Ministry of Industry and Information Technology, and the Ministry of Environmental Protection and other departments have frequently issued guidance on power battery recycling in recent years to standardize the power battery recycling system and promote the maximum and efficient use of resources. The vehicle power battery recycling industry is bound to become the next blue ocean market in the field of new energy vehicles.

Copyright 2006-2021, Design placeholder Fulbright Medical Inc.Design by VPA Brand. 沪ICP备17052696号-4