Recently, KeyKing Recycle .Ltd completed hundreds of millions of CNY in Series A and A+ rounds of financing. Continuous successful financing shows the arrival of the next super investment outlet in the new energy industry - comprehensive utilization of lithium battery recycling!

Its A round financing introduced a strategic investor, Yinan Capital, a PE investment fund of Sinochem International; Yujun Investment—Linyang Energy’s PE fund; Zhida Investment——Shanghai Zhida Group‘s PE. The A+ round introduces CITIC New Future—the PE of CITIC Holdings; Infinity—the equity investment platform of HuaFa Group;Guangxi Invesrment Group Company Limited。ZK Capital co-invested in the two rounds of financing and acted as the only FA. A large number of industry parties and well-known investment institutions have been introduced in this financing, and their funds will be used for the construction of new production lines, increase upstream and downstream cooperation, and take advantage of the dual-carbon wind to accelerate the closure of the lithium battery cycle industry chain.

Keyking Cycle is mainly engaged in the recycling of waste lithium batteries and other lithium-containing battery waste, and as the only company in China that prepares battery-grade lithium carbonate through a one-step process, it leads the development of cutting-edge technology in the lithium battery recycling industry. In 2021, the company will produce nearly 3,000 tons of battery-grade lithium carbonate by recycling various lithium-containing wastes and ternary wastes, and realize a net profit of over 80 million CNY, ranking first in the industry in recycling and preparing electric carbon .The company has a number of exclusive process technologies, including charged battery crushing, ternary extraction of lithium first and then nickel and cobalt, selective leaching of lithium iron phosphate to extract lithium, recycling of battery-grade iron phosphate, and one-step preparation of battery-grade lithium carbonate, etc. 66 patents have been authorized and in the trial stage. All lithium batteries and lithium-containing waste can achieve a lithium recovery rate of more than 95%-99%, exceeding the industry average (80%-85%). The core founder of the company graduated from the Metallurgical Department of Central South University. He has many years of practical experience in beneficiation and hydrometallurgical processes, and has applied his previous experience to the recycling process of lithium waste, making his technical level ahead of his peers.

As a benchmark enterprise in the recycling of lithium resources in China, KeyKing Cycle is guided by technology research and development, and continuously improves the extraction rate of lithium elements and product purity, making its product quality highly praised by customers in the industry. In November 2021, the Department of Energy Conservation and Comprehensive Utilization of the Ministry of Industry and Information Technology released the list of enterprises (third batch) that meet the "Industry Standard Conditions for Comprehensive Utilization of Waste Power Batteries of New Energy Vehicles", and KeyKing Cycle was among them.

ZK’s view: Driven by the " carbon neutral and peak" strategy, China's new energy industry is accelerating its development.

In 2021, the national sales of new energy vehicles will reach 3.545 million, a year-on-year increase of 159.3%, and the domestic penetration rate of new energy vehicles will reach 13.4%. The new energy vehicle market in Europe has risen in the past two years. In the eight European countries dominated by Germany, France, the United Kingdom, Norway, Italy, Sweden, Spain and the Netherlands, the overall penetration rate in 2021 is about 21%, and the United States is only 4%. Global new energy vehicles are in a period of rapid development. As the global new energy industry has entered a stage of rapid development, lithium batteries, as an essential element in the new energy industry, have experienced exponential growth in demand. In 2021, the total domestic power battery production has reached 219.26 GWh, corresponding to a demand of 120,200 tons of battery-grade lithium carbonate. It is estimated that by 2030, the domestic demand for battery-grade lithium carbonate will exceed 1.115 million tons.

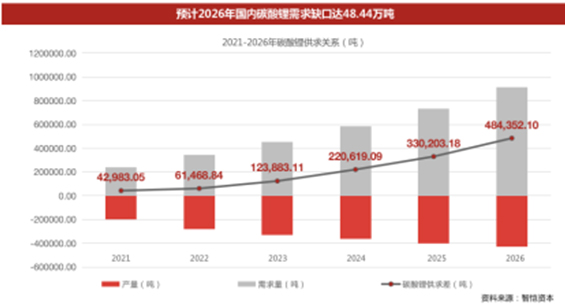

The gap in demand continued to widen

Due to the restrictions on the exploitation of upstream lithium resources and the large demand in the downstream battery market, the supply of lithium resources will continue to have a demand gap in the next few years. It is estimated that in 2022, the gap between the domestic lithium carbonate resource end and the downstream demand end will be around 61,500 tons. After 2023, due to the rapid growth of demand for new energy vehicle power batteries, the market demand for battery-grade lithium carbonate will increase rapidly, and the demand gap will continue to expand. The gap is expected to reach 484,400 tons by 2026. Due to the insufficient supply of the resource end itself, the gap between supply and demand needs to be filled by the recycling. In this context, the battery recycling market has also ushered in a "blowout" period.

Ending

In the next five years, the huge demand for power batteries in the new energy vehicle market will continue to drive the demand for domestic battery-grade lithium carbonate. The continuous expansion of the demand gap for lithium resources has made power battery recycling the next important investment outlet in the field of new energy. Keyking Cycle will quickly complete the B round and follow-up financing, and plans to land in the capital market IPO in 2023-2024, and continue to lead the technological breakthrough and industry development of the lithium battery recycling industry.

ZK Capital focuses on market trend research, competitive landscape analysis, and investment opportunity judgment of new energy, new materials, and the automotive industry chain. At the same time , ZK capital helps to enable VC, PE investment, a professional investment and financing service organization that clears up the fog for investment and discovers trends and market truths.

Copyright 2006-2021, Design placeholder Fulbright Medical Inc.Design by VPA Brand. 沪ICP备17052696号-4